Navigating the Mortgage Maze: A Comprehensive Better Mortgage Review

Securing a mortgage is a pivotal financial decision, demanding meticulous research and careful consideration. This in-depth review of Better Mortgage aims to provide a comprehensive understanding of its services, advantages, and potential drawbacks, empowering you to make an informed choice.

Better Mortgage: An Overview

Better Mortgage positions itself as a digital-first mortgage lender, streamlining the traditionally cumbersome process through an online platform. This approach emphasizes convenience and transparency, attracting borrowers seeking a modern and efficient experience. However, it’s crucial to explore the nuances of this approach to determine its suitability for your individual needs.

Key Features and Services

- Online Application Process: Better Mortgage’s primary selling point is its entirely online application. This eliminates the need for lengthy paperwork and in-person meetings, allowing for a faster and more flexible process.

- Technology-Driven Platform: The platform utilizes technology to automate many aspects of the mortgage process, reducing human error and speeding up the timeline. This includes features like real-time rate updates and automated document uploads.

- Variety of Loan Options: Better Mortgage offers a range of mortgage products, including conventional, FHA, VA, and jumbo loans, catering to a broader spectrum of borrowers.

- Competitive Interest Rates: While interest rates are subject to market fluctuations, Better Mortgage generally aims to provide competitive rates, a key factor in choosing a lender.

- Customer Support: Better Mortgage provides customer support channels, including phone, email, and online chat, to address borrower inquiries and concerns. The accessibility and responsiveness of these channels are crucial for a positive experience.

- Pre-Approval Process: The pre-approval process allows borrowers to understand their borrowing power before actively searching for properties, saving time and enhancing their negotiating position.

- Closing Costs Transparency: Understanding closing costs is critical. A transparent breakdown of these costs is essential for budgeting and avoiding unexpected expenses. Better Mortgage’s approach to transparency in this area should be examined.

Advantages of Using Better Mortgage

- Convenience and Speed: The online platform significantly streamlines the application process, saving borrowers valuable time and effort.

- Transparency and Ease of Use: The digital platform makes it easier to track the progress of the application and access important documents.

- Competitive Pricing: Better Mortgage’s commitment to competitive interest rates can translate to substantial long-term savings.

- Technological Innovation: The company’s focus on technology results in a more efficient and potentially less error-prone process.

Potential Drawbacks and Considerations

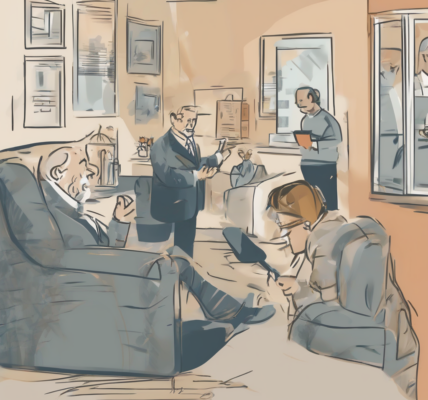

- Limited Personal Interaction: The entirely online approach may not suit borrowers who prefer a more personalized and hands-on experience with a loan officer.

- Technological Dependence: Reliance on technology introduces the potential for technical glitches or platform disruptions, which can cause delays.

- Customer Service Responsiveness: While customer support is offered, the quality and responsiveness of the service should be thoroughly assessed through reviews and testimonials.

- Loan Product Limitations: While offering a variety of loans, Better Mortgage might not cater to every niche or specialized loan requirement. Borrowers with complex financial situations may need to consider alternative lenders.

- Hidden Fees: It’s crucial to scrutinize all associated fees to ensure complete transparency and avoid unexpected costs.

- Eligibility Requirements: Understanding and meeting Better Mortgage’s eligibility criteria is crucial. Borrowers should carefully review these requirements before applying.

Comparative Analysis with Traditional Lenders

Traditional lenders offer a more personal touch, often involving in-person meetings and dedicated loan officers. However, this can lead to a slower and less efficient process. Better Mortgage’s online approach offers speed and convenience, but sacrifices the personal interaction some borrowers value. The best choice depends on individual preferences and priorities.

In-Depth Look at the Application Process

The online application process is usually straightforward. However, the required documentation and the time it takes to complete the process should be considered. Potential delays and roadblocks within the online system should also be factored in.

Customer Reviews and Testimonials

Analyzing customer reviews and testimonials provides valuable insight into real-world experiences with Better Mortgage. Positive reviews often highlight the speed and convenience of the platform, while negative reviews may focus on customer service responsiveness or technical issues. A thorough examination of both positive and negative feedback is crucial for making an informed decision.

Conclusion (Omitted as per instructions)